Are you trying to pay off debt and want an easy way to see your progress? Our Free Debt Tracker Printables for 2025 are made to help you stay organized, make better choices, and feel proud every time you pay down what you owe. With these trackers, managing your debt is less stressful and a lot more encouraging.

Table of Contents

Features of Debt Tracker Printables

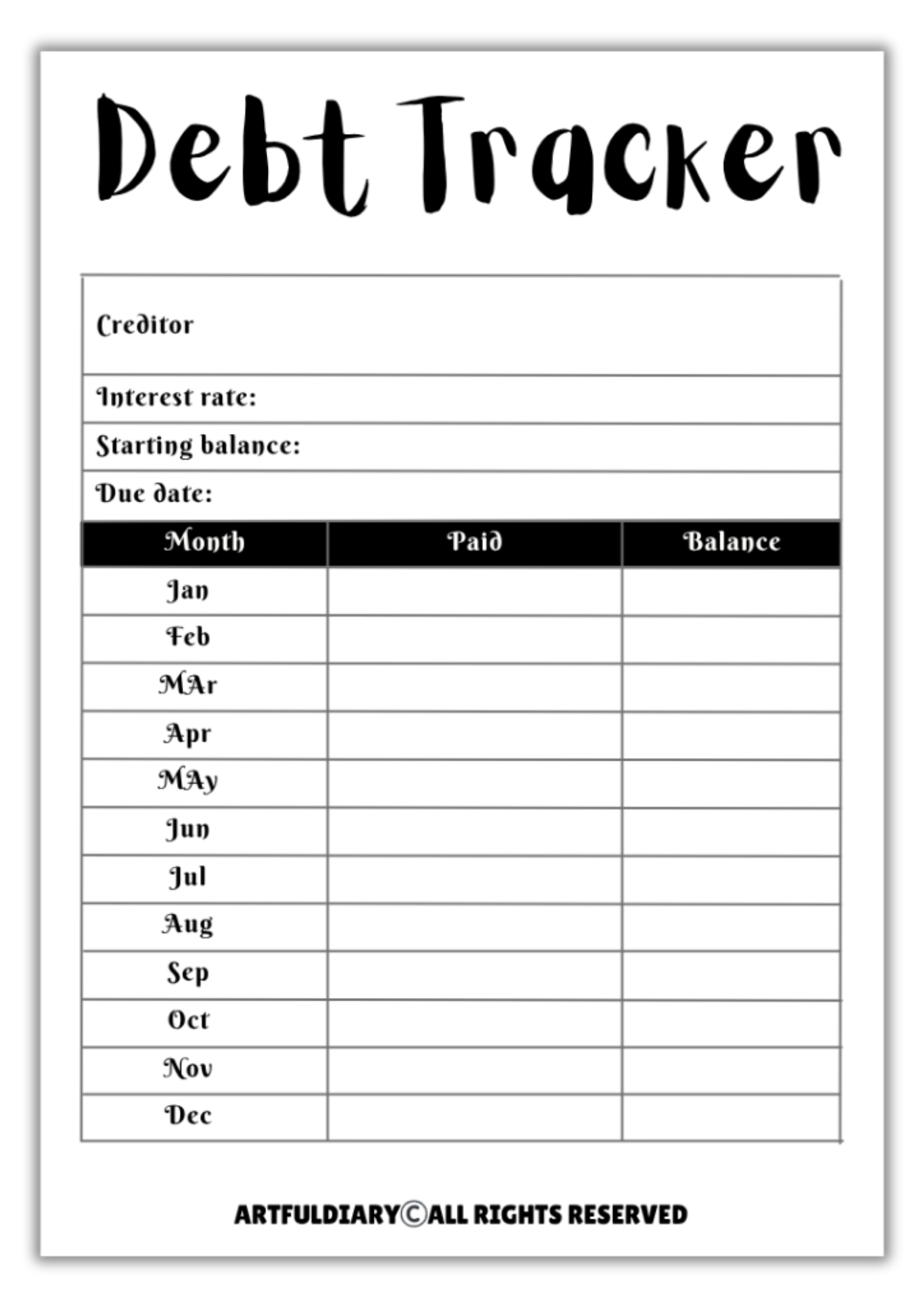

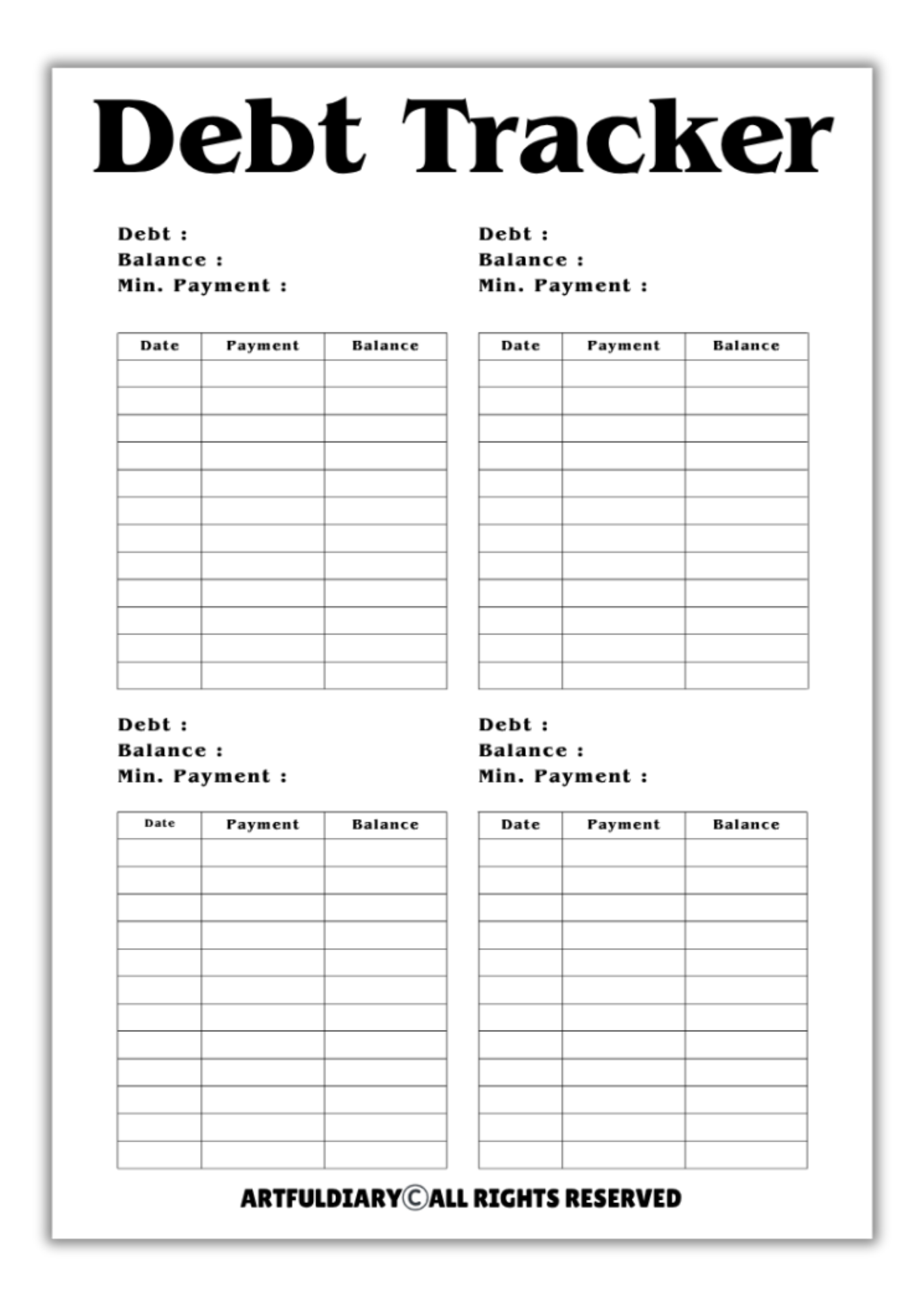

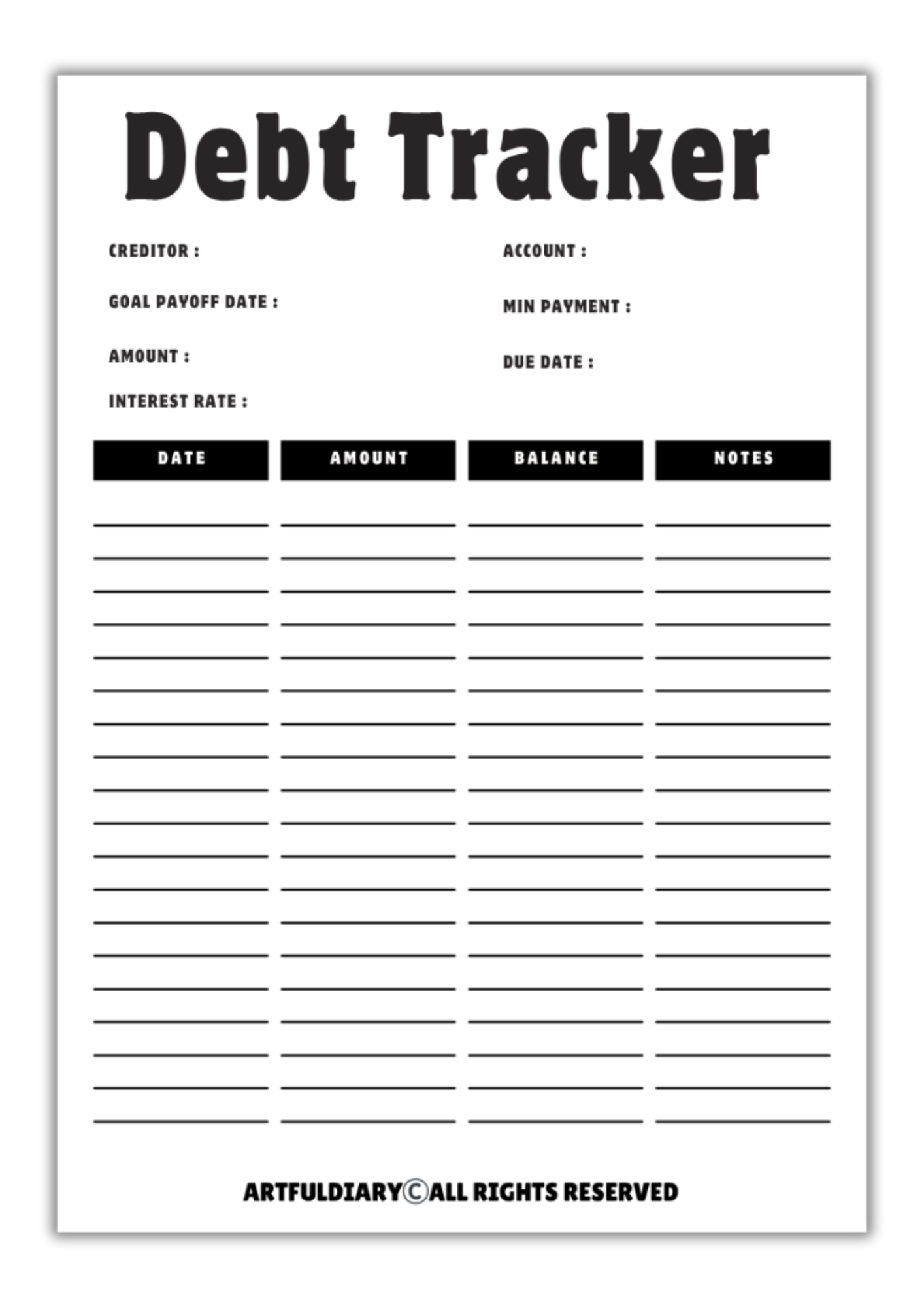

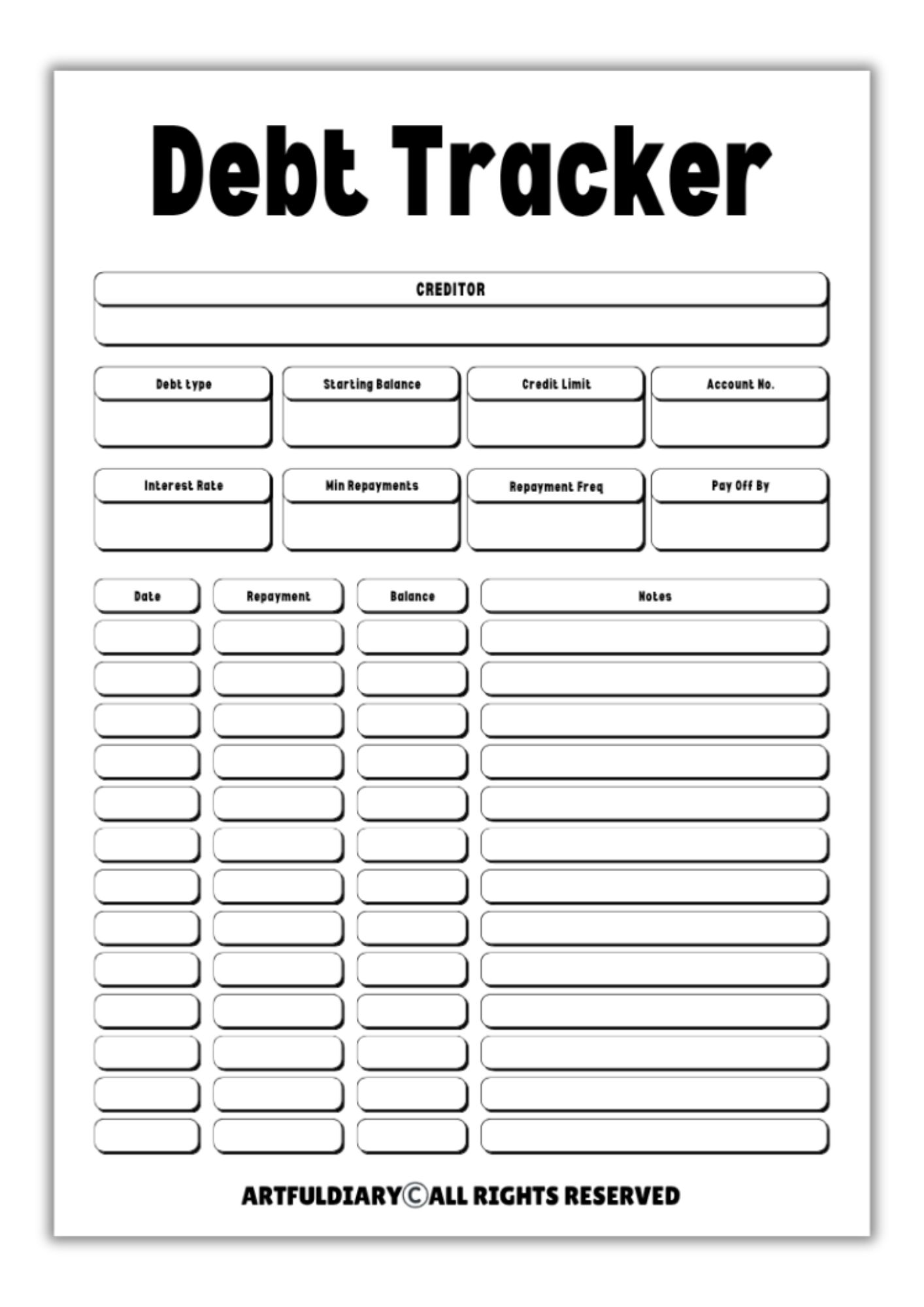

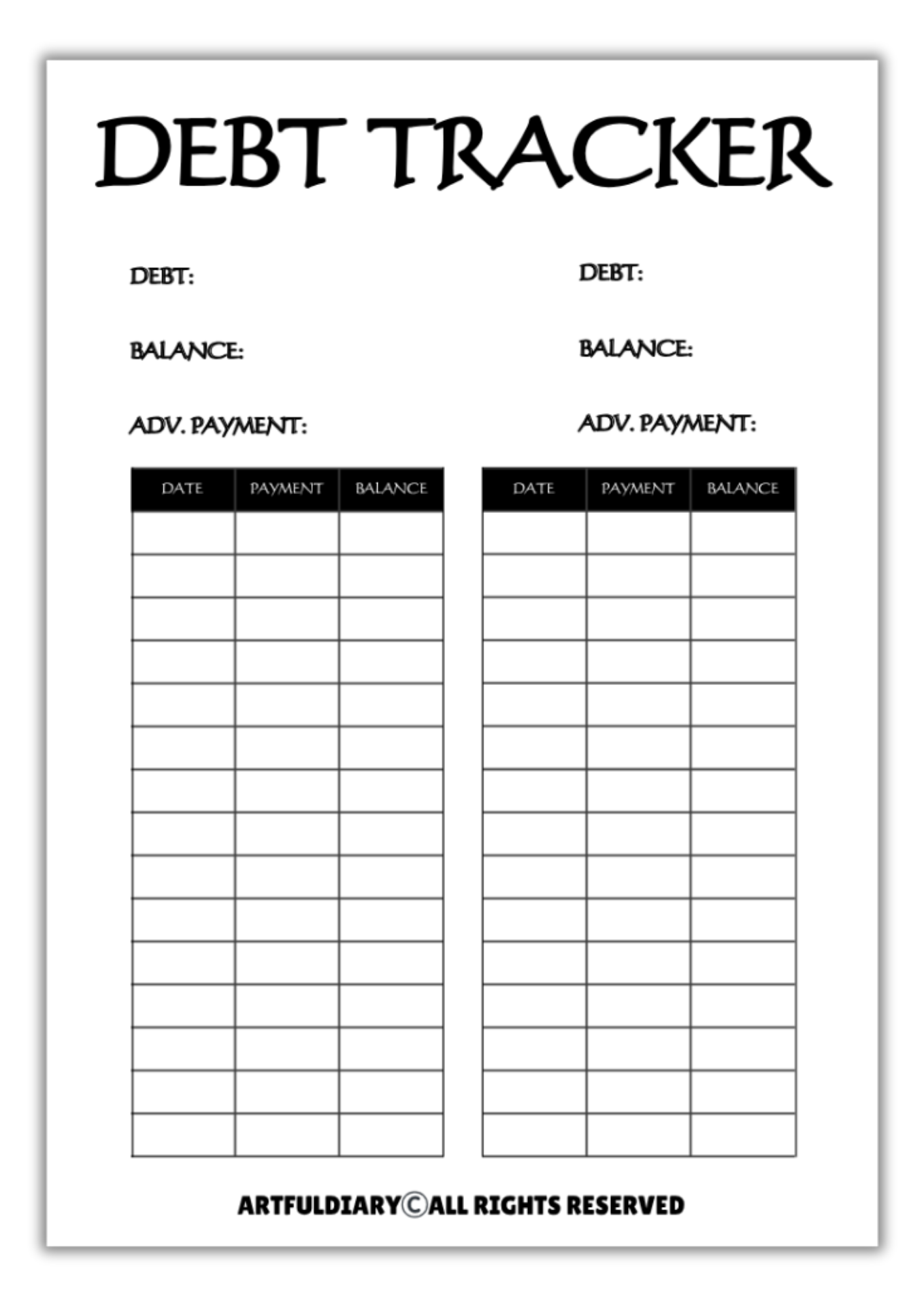

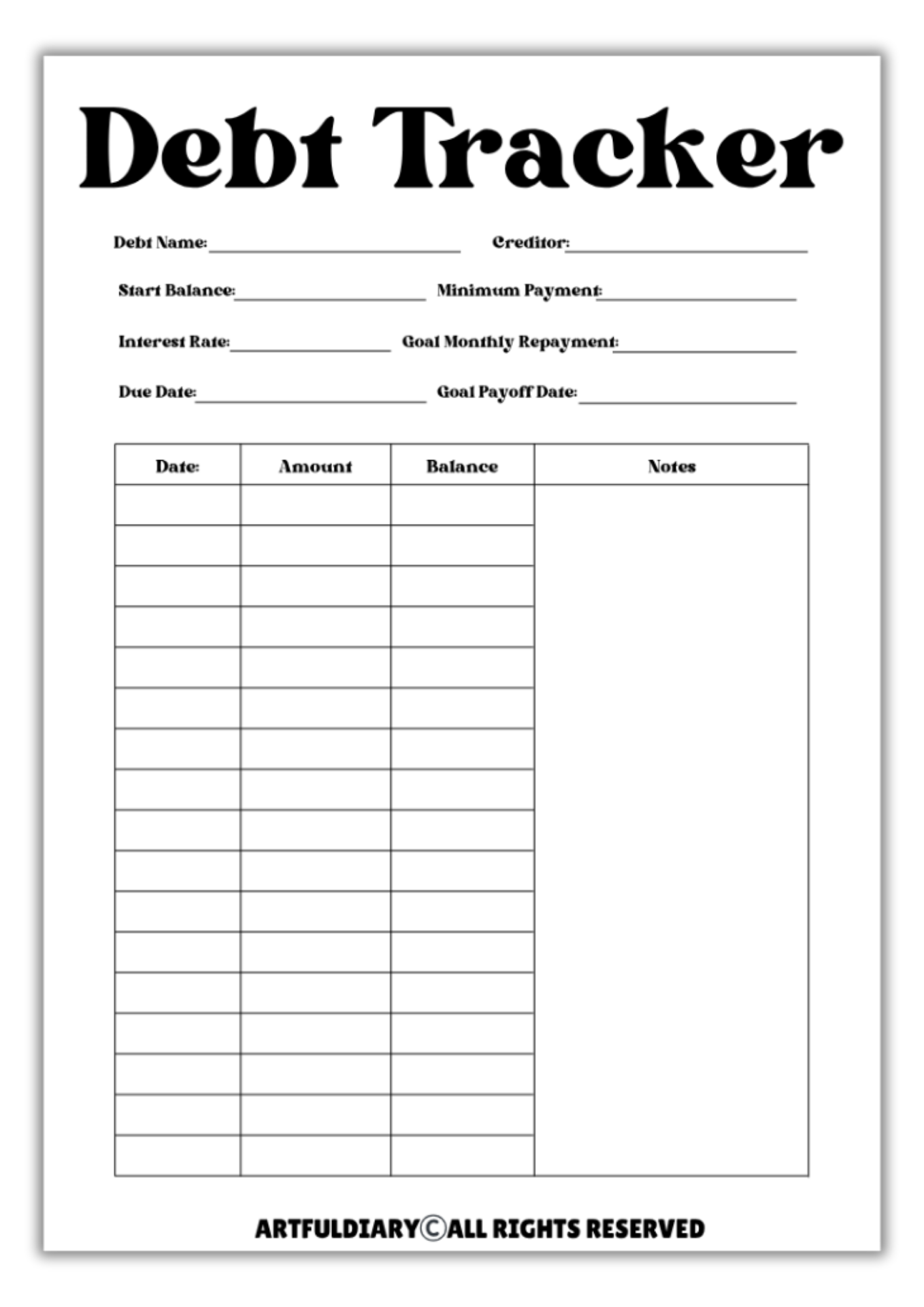

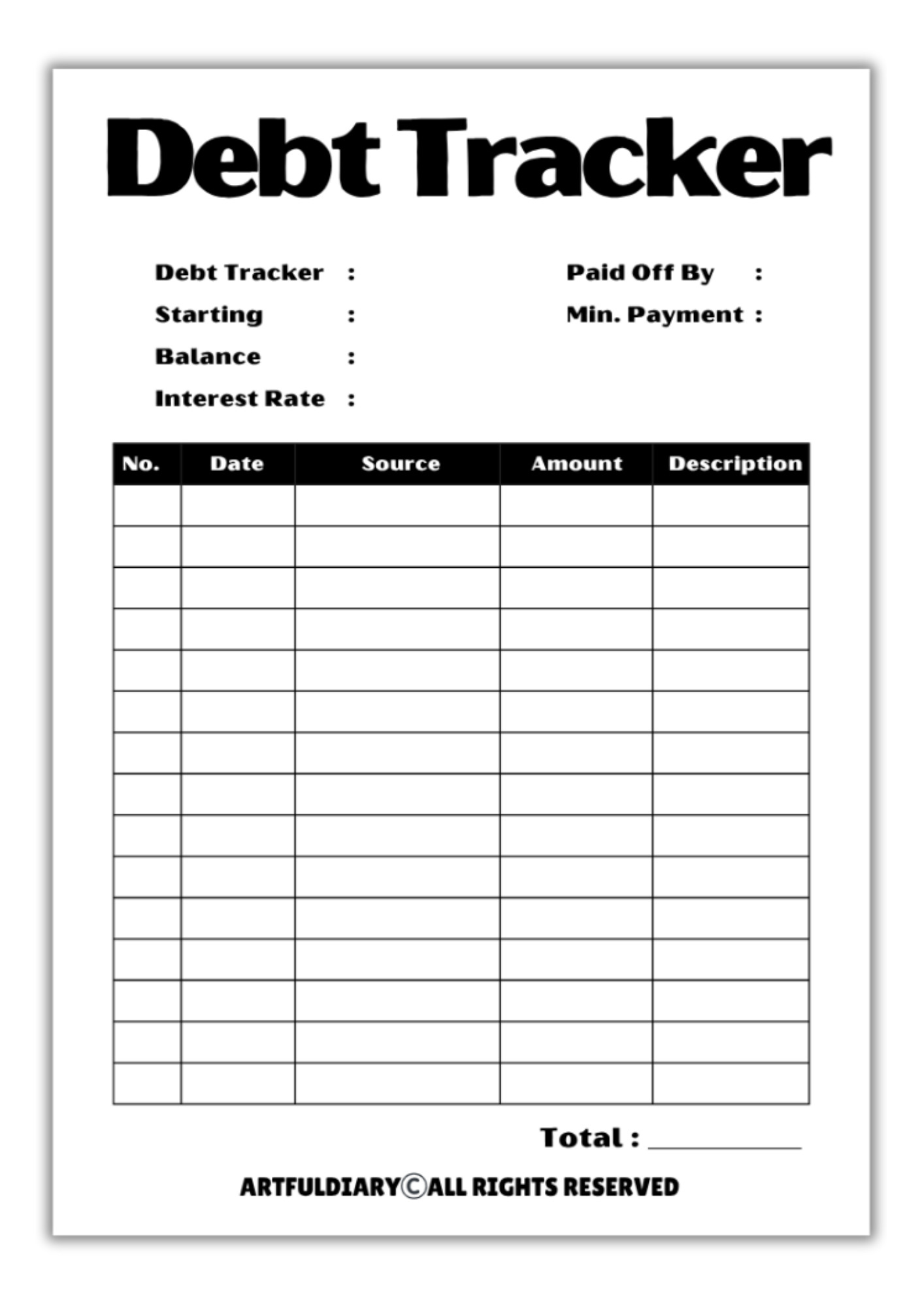

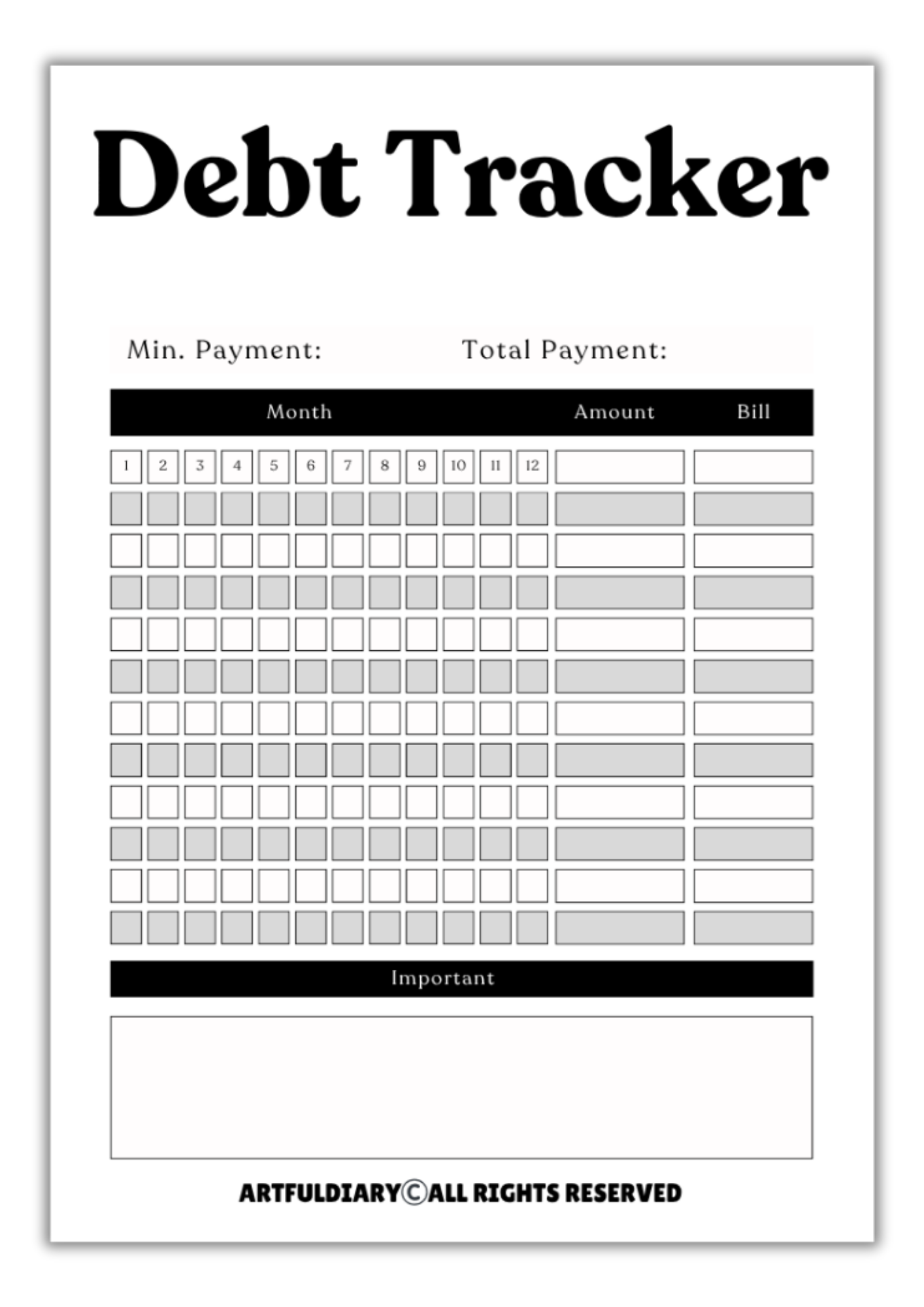

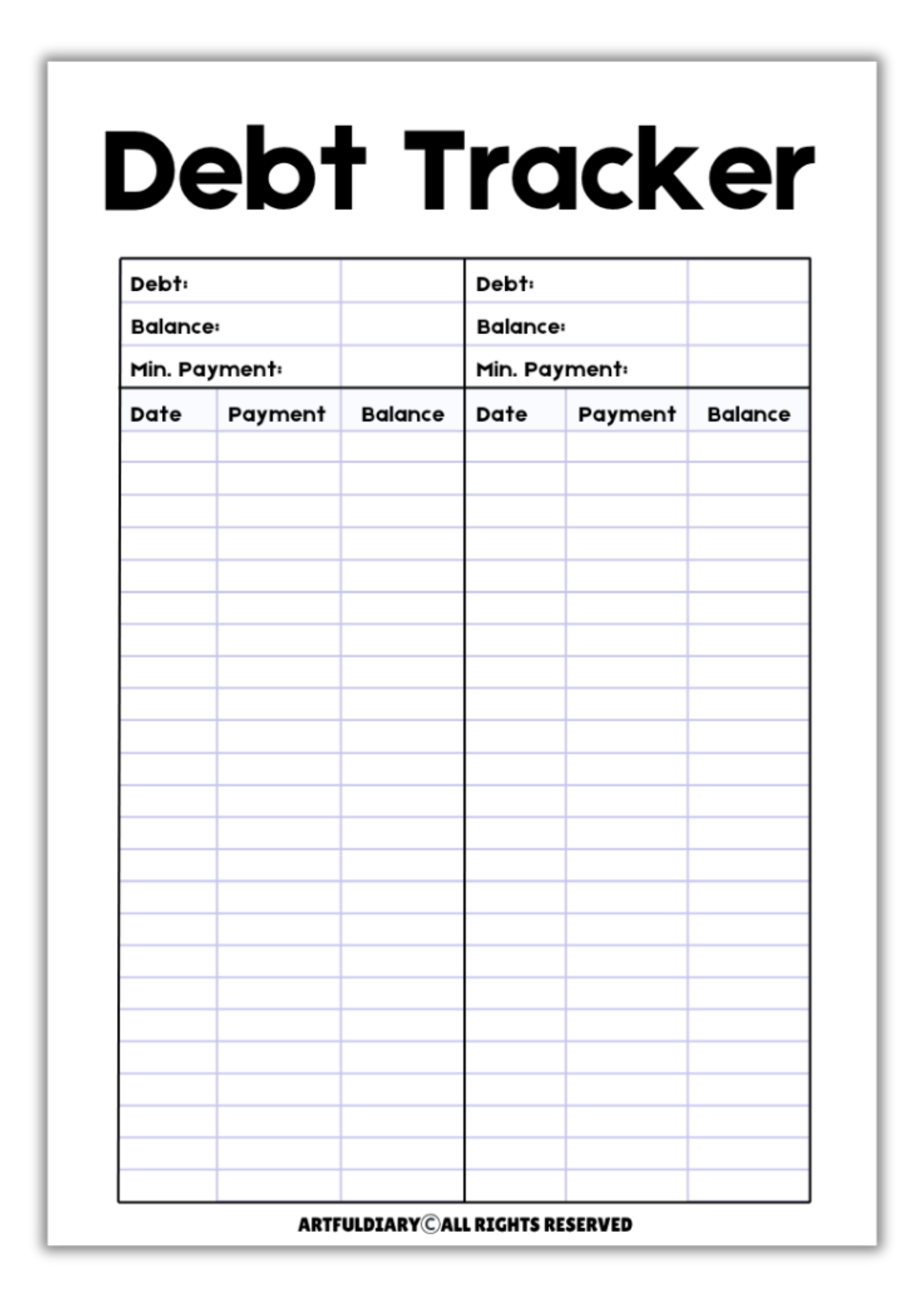

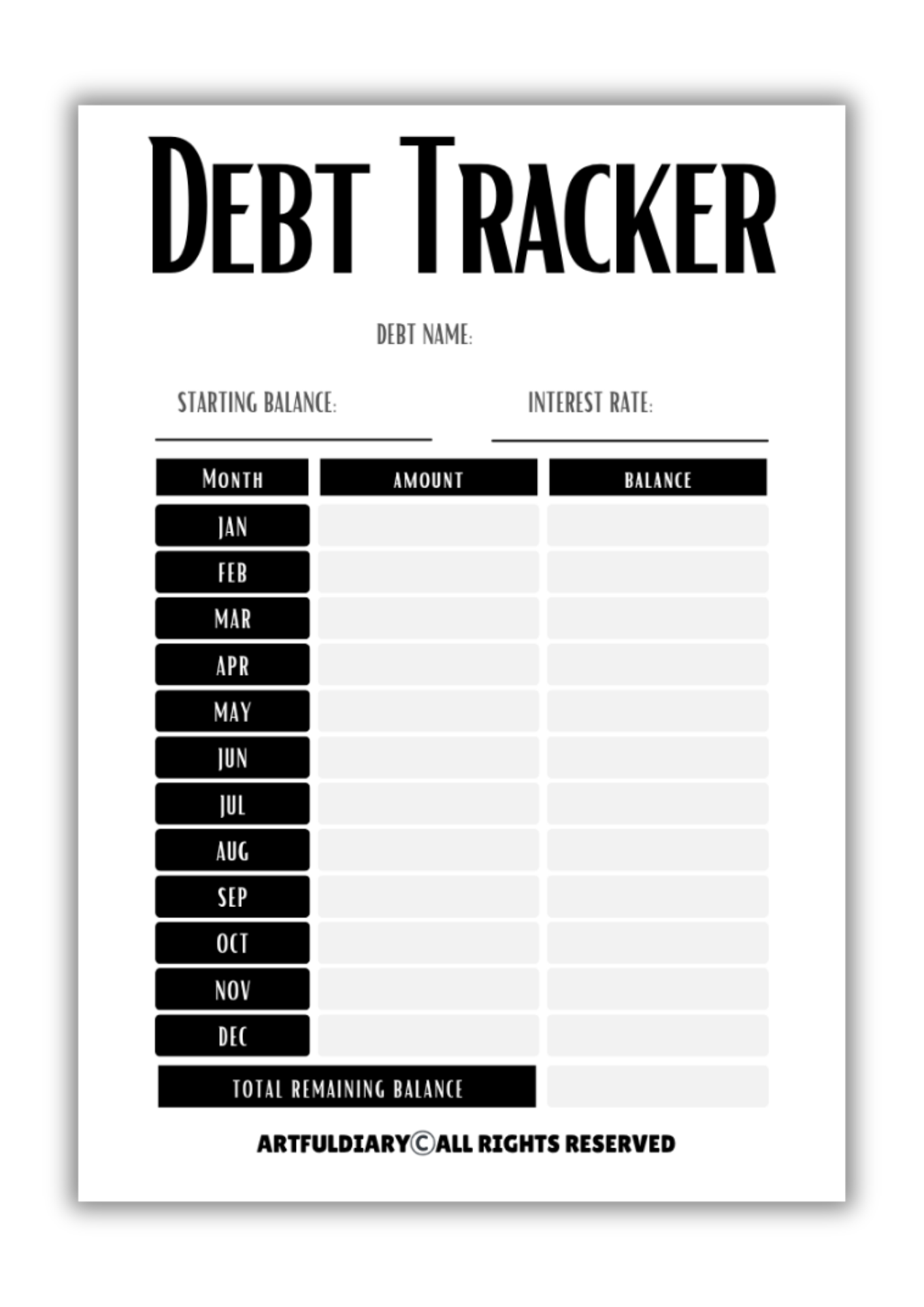

Take charge of your debt with our brand-new set of 20 stylish printable debt tracker templates, all at no cost to you! Each sheet is designed in a standard 8.5×11 inch format, making home printing or digital use a breeze. You’ll find an assortment of designs—from neat, straightforward logs to bold, motivational layouts and colorful, modern planners—so you can pick one that matches your personality and needs.

Our free debt tracking templates are created to support you with day-to-day financial planning, no matter if you’re paying off a personal loan, chipping away at several balances, or just aiming to get organized. These thoughtfully arranged pages allow you to:

- List each debt or bill in its own spot

- Keep tabs on amounts, lenders, interest rates, and due dates

- Log every payment and update your remaining balances

- Visualize progress with fillable charts, milestone markers, or payoff bars

- Add your own notes, reminders, and personal goals

With these printable, managing your finances gets easier—and a lot more motivating—as you see your hard work pay off, one step at a time.

Free Debt Tracker Printable

Download your favorite debt tracker printable, fill it in, and start seeing your balances go down. Whether you have student loans, credit cards, or other bills, a tracker can help you stay focused and positive. Remember, every payment is a step closer to financial freedom

Why Use a Debt Tracker Printable?

Using a debt tracker can make a big difference on your journey to financial freedom. Here’s how it helps:

- See Your Progress: Color in or tick off boxes every time you make a payment. Watching your debt go down is very rewarding.

- Stay Motivated: Keeping track means you’re less likely to forget a payment and more likely to reach your goal.

- Stay Organized: List all debts in one place so you always know where you stand.

- Make Better Plans: Choose which debt to pay off first—smallest balance or highest interest—it’s up to you.

- Customizable: Use one tracker per loan, or one for all debts. Available in different styles and sizes.

Tips to Pay Off Debt Faster

- Pay More Than the Minimum: Even a little extra helps your balance go down quicker.

- Focus on High-Interest Debt: The “avalanche” method saves money over time.

- Automate Payments: Set up auto-pay to never miss due dates.

- Combine with a Budget: Use your debt tracker with a monthly budget for best results.

Recommended Supplies:

Enhance your crafting and printable experience with these essential tools and materials. We’ve handpicked the best products to complement our free printable. Get professional-level results with a few key supplies:

- Printer: We recommend an inkjet or laser printer for crisp lines and color pops. (Check the HP Smart-Tank 5000 for affordable, high-quality prints recommended by CNET, 2024.)

- Paper: For everyday pages, high-quality inkjet paper (90–120 GSM/24–32 lb) resists ink bleed. For covers, use sturdy cardstock (160+ GSM/45+ lb).

- Pens & Highlighters: Gel or felt-tip pens glide smoothly; mildliner highlighters let you color-code without bleed-through.

- Binder/Disc Organizer: Store your printed pages for easy access and organization. Try a 3-ring binder or disc system like Happy Planner for flexibility.

- Scissors & Glue (Optional): Cut or paste planner pieces if you like getting crafty.